Germany?s Spending Plan Reignites Jitters Over Periphery Debt

By Alice Atkins and Greg Ritchie

March 21, 2025 at 6:00 AM UTC

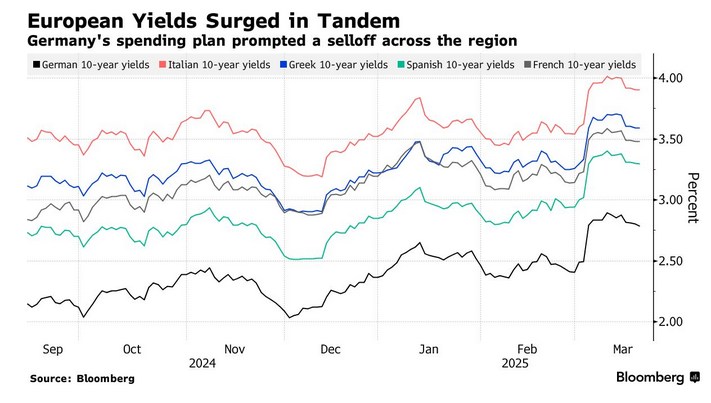

Germany's increased spending is causing borrowing costs to rise across Europe, particularly in countries with high debt loads such as Italy, Greece, Spain, and Portugal.

- This shift in Germany's fiscal policy could lead to a more relaxed approach to debt across Europe, weakening confidence in government bonds and raising borrowing costs for highly indebted nations.

- The risk is not limited to the periphery, as debt levels in France and Belgium have also increased, making them vulnerable to higher interest rates and a potential blowout in bond markets.

Germany?s new era of big spending is pulling up borrowing costs across Europe, reigniting jitters around fiscal stability on the continent?s periphery.

Yields on benchmark Italian, Greek, Spanish and Portuguese bonds are over 30 basis points higher compared to the start of the month. The four countries, which were bundled together during Europe?s sovereign debt crisis more than a decade ago, still have some of the highest debt loads on the continent, making them vulnerable to higher interest rates.

Germany has long been the voice of fiscal discipline in the European Union ? pushing for countries like Italy and Spain to tighten their purse strings and opposing the issuance of joint debt. But if that policy led to complaints of weak growth, the new, more relaxed approach to spending could have negative implications of its own for Europe?s most indebted countries.

?If Germany embraces deficit spending, other nations may follow suit, leading to a more relaxed approach to debt across Europe,? said Robert Burrows, a portfolio manager at M&G Investments, who says he has reduced his holdings of periphery debt. ?This could weaken confidence in European government bonds, raising borrowing costs for highly indebted nations.?

-------------------

FF: Ähnliches hatte ich hier bereits vor etwa einer Woche geschrieben, was wie üblich als Spinnerei abgetan wurde.

Der Euro ist zum Dollar ebenfalls deutlich gefallen in den letzten Tagen.

|

Angehängte Grafik:

2025-03-....jpg (verkleinert auf 71%)

1 |

... |

7905 |

7906 |

|

7908 |

7909 |

...

| 7910

1 |

... |

7905 |

7906 |

|

7908 |

7909 |

...

| 7910

Thread abonnieren

Thread abonnieren