Break Through 10,600

Dow rallies through key 10,600 level, holds at highs.

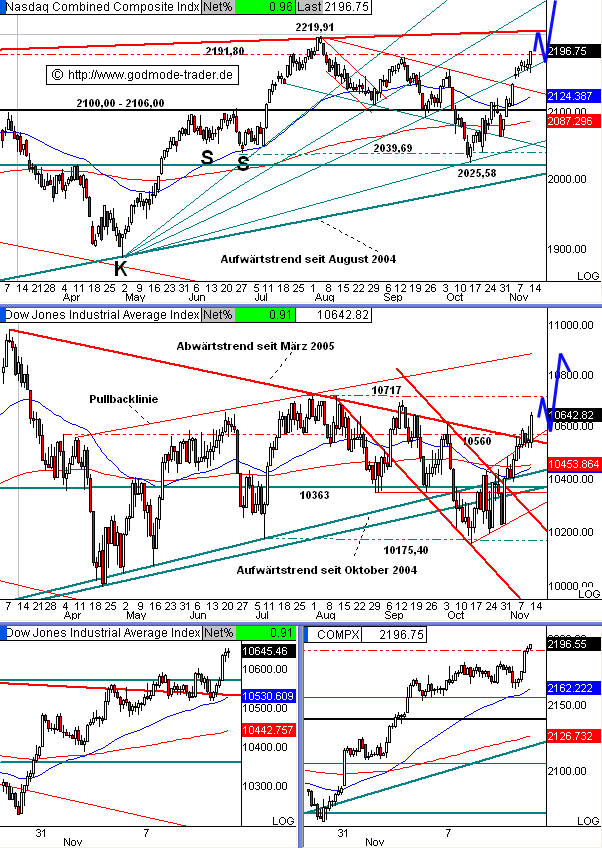

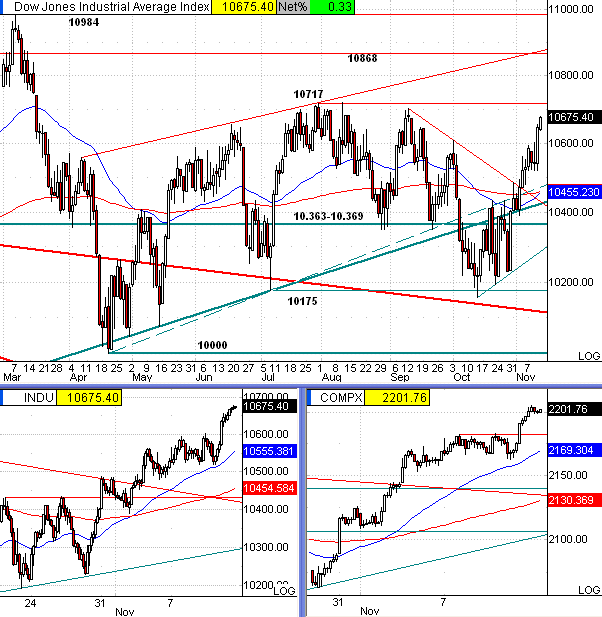

From prior commentary, "...The Dow is clearly gearing up for a huge move, as illustrated by the behavior beneath the 10,600 level...A solid upside break through 10,600 will likely set off a big near-term rally..." The Dow opened the session relatively weak this morning, as the index tested the 10,520 for the fourth straight session, seen in the 5 and 15 Minute Charts. The index got a healthy bounce off this level and eventually reeled off a solid 135 point rally after breaking though the key 10,600 resistance level, seen in the Daily and 60 Minute Charts.

The Dow closed the day higher by 94 points and looks to be setting up for a big upside move in the market. If the Dow can continue holding above 10,600, we could see a test of the August highs at 10,720 in no time.

The index should continue to be considered bullish in the medium term, especially if it continues to hold above 10,500. Only a break through this level will cause a major sell-off.

Short Term Dow

The Dow closed the day above the 10,600 resistance level, seen in the 5 Minute Chart. Watch for strength above this level tomorrow morning, unless a violation occurs.

Medium Term Dow

In the medium term, we entered Longs at 10,600 today and are still in the trade. We currently have 45 points in the trade and will hold stops at the entry for tomorrow's market. We will want to stay Long above 10,675, but will hold off on Shorts, unless 10,500 is crossed to the downside; using 20 point stops.

NASDAQ & S&P

The NASDAQ and S&P each rallied from the lows of the session to end the day at the highs of the past of the past month. Look for a continuation pattern to indicate continued strength is likely.

Summary

The Dow ended the day at the highs of the session after blasting through the major 10,600 resistance level. As we mentioned before, this level was the only thing holding the Dow back from a major rally. If the index can continue to hold above this zone, we could see quite a lift off.

Thanks for listening, and Good luck in your trading!

Ed Downs

edowns@nirvsys.com

with assistance from..

Frank Ochoa, Sr. Market Analyst

fochoa@nirvsys.com

** Note: We are now posting Index entries and exits in Real Time, through our new Intraday Index Alerts service. To learn more about the service, visit SignalWatch.com and select Intraday Alerts from the main navigation bar. - SW Team

1 |

... |

44 |

45 |

46 |

|

48 |

49 |

50

1 |

... |

44 |

45 |

46 |

|

48 |

49 |

50

Thread abonnieren

Thread abonnieren