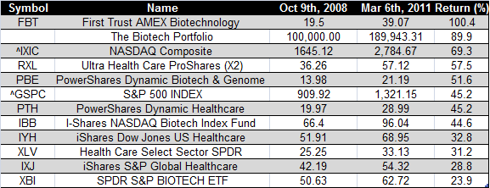

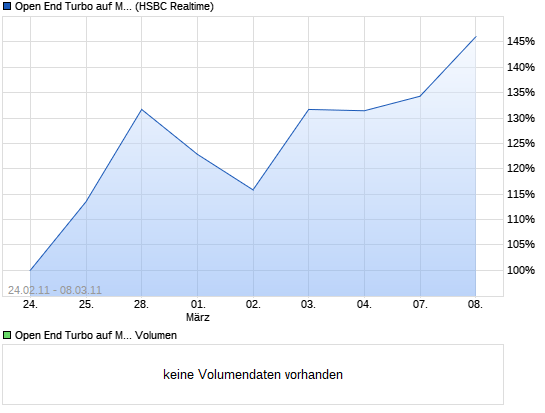

Morphosys' Growth Story Remains Intact - Seeking Alpha by: Ohad Hammer March 07, 2011 Last month, Morphosys (MPHSF.PK) reported its 2010 earnings, which seems like a good point of revisiting the stock. Last time I wrote about Morphosys (see article) was almost two years ago. Since then, the company has made a lot of progress but still without reaching a real value creation event. Nevertheless, Morphosys’ value proposition is now greater than ever, as it still offers a rare opportunity to invest in the fastest growing segment of the pharma industry with limited downside. An ideal blend Morphosys has an ideal blend of activities, including high risk proprietary pipeline, a huge partnered pipeline (primarily with Novartis) and low risk research and diagnostics business. The internal pipeline now comprises three clinical programs, including a phase II study in rheumatoid arthritis. The partnered pipeline grew from three to 14 (!) clinical stage programs with a host of partners including Novartis (NVS), Pfizer (PFE) and J&J (JNJ). The AbD Serotec business is marginally profitable, bringing in $1.2M in net profit. The most attractive aspect in this business model is the partnered pipeline, as Morphosys does not have to pay for the development and is entitled to milestone payments and royalties. The modest milestone payments (~$15M) and <5% royalty stake add up to a substantial amount, even assuming that only a handful of candidates reach the market. Importantly, Morphosys has the right to co-develop some of the Novartis’ programs, which could increase its exposure to additional attractive programs. These funds together with the AbD Serotec activity more than offset the high costs and risk associated with the company’s internal pipeline. Accelerating partnered pipeline The partnered pipeline includes 14 antibodies in clinical testing, developed in the hands of large partners such as Novartis (NVS), Johnson&Johnson (JNJ), Roche (RHHBY.PK), Pfizer (PFE) and Bayer (BYERF.PK). The past few months saw a steep increase in the number of clinical stage programs, including 3 new programs announced in January alone. Investors should expect additional programs to reach the clinic during 2011. From a financial perspective, the partnered business segment generated over $40M in profits in 2010, which were used to finance Morphosys’ internal pipeline. The most significant partner is obviously Novartis, given the vast scope of the collaboration between the two companies. Going forward, this deal is expected to yield the majority of new clinical programs, especially in light of Morphosys’ decision not to engage in similar deals with other companies. An important aspect in the Novartis collaboration is the option Morphosys has to co-develop certain antibodies alongside Novartis. This is very appealing as it will allow Morphosys to selectively retain a higher stake than the usual 5% royalties in programs it finds attractive. Despite the massive number of partnered programs, it is hard to ascribe meaningful value to any of them. The majority of programs have yet to generate clinical data and those that did, could not demonstrate compelling activity. One potential exception is Roche’s gantenerumab which showed intriguing signs in Alzheimer patients but it is still very early in the development process. In mid 2010, Morphosys announced that one of the Novartis programs reached “clinical proof of concept” without giving additional information. This is encouraging even though it is hard to draw anything definitive from such a vague statement. Hopefully, during 2011 Novartis will shed more light on this program, currently in phase II, as pharma companies typically disclose all of their advanced stage products. This could be the most important event for Morphosys in 2011. Morphosys’ internal pipeline Morphosys has been very active in advancing its internal pipeline during 2010. Its internal pipeline includes three antibodies in clinical testing: MOR103 (rheumatoid arthritis, phase II), MOR208 (CLL, phase I) and MOR202 (multiple myeloma, about to start phase I). MOR103 MOR103 targets GM-CSF and was shown to be safe in a phase I in healthy volunteers. The company is enrolling patients in a medium size phase II in RA patients in order to show clinical efficacy. Data from this trial is expected only next year, so this program is not expected to generate significant news during 2011. The company intends to start a phase II in multiple sclerosis as well. Morphosys has what it claims to be a broad US patent that covers GM-CSF as a target. This may block others from commercializing anti GM-CSF antibodies in the US, which could be a huge advantage if GM-CSF becomes a valid target in inflammatory diseases. Other companies are developing anti-GM-CSF antibodies are Micromet (MITI) (phase I, in collaboration with Nycomed) and Seattle based Theraclone (preclinical). MOR208 Last year, Morphosys obtained MOR208 through a licensing deal with Xencor. MOR208 targets CD19, a well validated target in a variety of blood cancers. This agent employs Xencor’s technology for enhancing antibodies ability to recruit the immune system via Fc optimization. The deal with Cencor got Morphosys into a highly competitive environment, where at least two drugs have already achieved clinical proof of concept (discussed here). Companies with CD19 agents in the clinic are Micromet, Sanofi-Aventis (SNY) [based on Immunogen’s (IMGN) technology], Medarex (part of BMS), Medimmune (part of AstraZeneca, based on Biowa’s technology) and Morphosys (based on Xencor’s technology). The market potential for CD19 antibodies is similar to that of Rituxan, which brings over $5B in sales annually. Nevertheless, as Rituxan is a highly effective drug, the barrier for capturing market share is rather high. The interesting thing with the CD19 arena is the fact that the different agents in development represent the three main approaches in next generation antibody development. Micromet’s drug is a bispecific antibody that aims at redirecting T cells to attack cancer cells whereas Sanofi’s CD19 agent is an antibody drug conjugate that employs Immunogen’s technology. The three other antibodies are engineered antibodies that recruit the immune system via their Fc region. Micromet’s blinatumomab (MT-103) has demonstrated impressive activity in NHL and ALL, where it is currently evaluated in a pivotal study. Sanofi’s SAR3419 also has clear activity albeit less stellar than Micromet’s agent but its mode of administration is more convenient. Sanofi already announced plans to start a phase II using more frequent dosing, which is supposed to result in enhanced activity. Phase I results for SAR3419 in the frequent regimen are expected at ASCO later this year. Although it is too early to pick a winner, Morphosys’ approach of using a Fc engineered CD19 antibody appears more problematic. Last year, Medarex halted two trials with its CD19 antibody, probably due to side effects. It remains to be seen whether MOR208 will also suffer from the same issues. As the Xencor deal was announced in June 2010, six months after the clinical hold for Medarex, one can assume Morphosys knew about these issues and still decided to go ahead with the deal. Data from the ongoing MOR208 phase I is could be available this December. MOR202 MOR202 is Mophosys’ earliest clinical program, expected to start phase I in multiple myeloma in the coming months. This antibody targets CD38 and will be the third CD38 antibody to enter clinical trials. Genmab has an ongoing phase II study with results expected later this year. Sanofi also has a CD38 program it licensed from Immunogen, currently in phase I. Upcoming milestones The company’s internal pipeline is expected to generate meaningful data only towards year end and the first half of 2012. MOR103 will report phase II data in 1H 2012, which will probably determine the fate of this agent in RA. Preliminary phase I results for MOR208 could arrive at ASH in December, although the company did not provide specific guidance for this program. As discussed, investors should be particularly cautious regarding MOR208 due to safety issues observed with a similar compound from Medarex. MOR202 is expected to enter phase I in multiple myeloma this year so it will probably take 12-18 months to see clinical data with this antibody. Results for competing CD38 programs from Genmab and Sanofi could shed some light on this target. As for the company’s partnered pipeline, it is impossible to predict news flow due to the large number of programs and the fact they are not run by Morphosys, let alone the nature of such updates. So far, the two most advanced programs, Novartis’ BHQ880 (anti-DKK1, multiple myeloma) and Centocor’s CNTO888 (anti-CCL2, cancer and pulmonary fibrosis) did not yield exciting results. It will be interesting to see results for the undisclosed Novartis program that reached clinical proof of concept, although the timing is unpredictable. Another program that could generate data this year is Bayer’s BAY 79-4620, an antibody drug conjugate against CAIX. This agent is in two phase I trials using two dosing regimens, one of which could have data this year. Summary In summary, Morphosys still remains a biotech rule breaker, as it has limited downside and substantial upside potential. Evidently, each proprietary and partnered program in Morphosys’ pipeline is very risky by itself and the majority of these agents will probably fail to reach the market. It is the sheer number of opportunities that creates the diversity of a large pharma with the size and growth potential of a small biotech. In terms of cash burn, the company expects to stay profitable in the coming years even though clinical expenses are ramping up, so no dilutions are expected. (Click charts to expand)

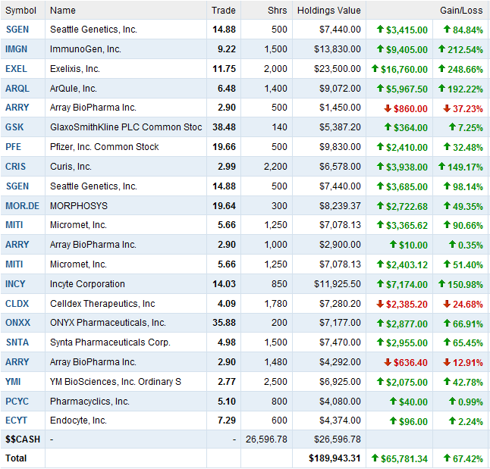

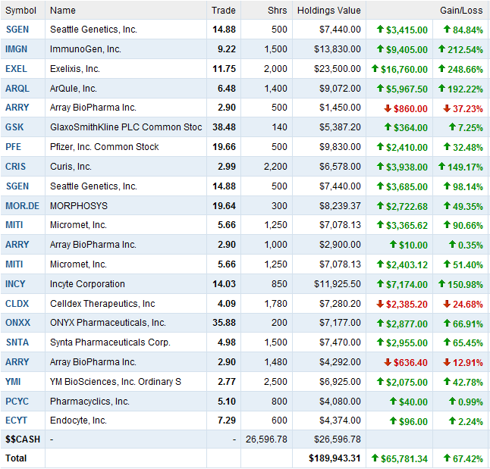

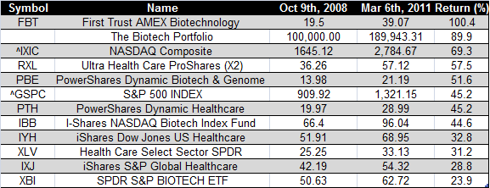

Portfolio holdings as of March 6th, 2011

Disclosure: I am long IMGN, MITI, MPHSF.PK.

-----------

Rech: "bei Versailles hat man auch nicht nach den Kosten gefragt"

Geissler: "Geld gibts wie Heu"

|

Thread abonnieren

Thread abonnieren