First Uranium beobachten

|

Seite 1 von 4

neuester Beitrag: 27.01.11 15:54

|

||||

| eröffnet am: | 29.01.07 22:07 von: | skunk.works | Anzahl Beiträge: | 83 |

| neuester Beitrag: | 27.01.11 15:54 von: | iuly68 | Leser gesamt: | 12544 |

| davon Heute: | 5 | |||

| bewertet mit 2 Sternen |

||||

|

2 |

3 |

4

|

2 |

3 |

4

|

||||

|

--button_text--

interessant

|

|

witzig

|

|

gut analysiert

|

|

informativ

|

2

Gelistet in Toronto bald in Johannesburg

Company Name: First Uranium Corporation

Industry: Mining

Symbols/Instruments: FIU - First Uranium Corp J

Date of Listing: 19 Dec 2006

Fiscal Year-end: MAR 31

http://www.tsx.com/...edPrices&Market=T&Language=en&QuoteSymbol_1=FIU

Firmeninfo

http://www.firsturanium.com/cws/projects/firsturanium/index.jsp

http://www.simmers.co.za/asp/default.asp

FIRST URANIUM IPO CONFIRMS VALUE OF SIMMERS? URANIUM STRATEGY

2007-01-17

Following the successful capital raising exercise that culminated in the listing of Simmer & Jack (Simmers) subsidiary First Uranium Corporation (FIU) on the Toronto Stock Exchange (TSX), where a total of 33 350 000 FIU shares were sold at C$ 7.00, grossing an amount of C$ 233 million

viel Glück

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

0

Toronto-listed uranium miner First Uranium planned to take up a secondary listing on the JSE during the first half of this year, Business Report said on Monday, citing CE Gordon Miller.

The company owns uranium and gold projects at Ezulwini on Johannesburg's West Rand and in Buffelsfontein in the North West.

To comply with foreign exchange regulations, the South Africa Reserve Bank requires that First Uranium take up a secondary listing on the JSE by next December, Business Report said.

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

0

TORONTO, Feb. 2 /CNW/ - First Uranium Corporation (FIU:TSX) today

announced that the company has mobilized its project teams and is making good

progress on several fronts with underground development at its Ezulwini

project and the evaluation and selection of the optimal process flowsheet for

the recovery of uranium at its Buffelsfontein project.

"The net result of these developments is very positive for First Uranium.

We now expect, subject to the completion of a feasibility study, that at

Buffelsfontein we should be able reduce costs and with activity already

underway at Ezulwini, we have gained even more confidence in our production

plan and budget," said Gordon Miller, First Uranium's Chief Executive Officer.

BUFFELSFONTEIN PROJECT

As the initial stage towards a feasibility study, First Uranium has

completed an evaluation to determine an optimised uranium recovery process for

its Buffelsfontein project uranium plant. The analysis was conducted by

K'Enyuka and Metallicon, independent metallurgical and mineral processing

engineers based in Johannesburg, on a number of recovery processes. The

initial results of this study suggest the most viable flowsheet would involve

pressure leaching. The base case contained in the Buffelsfontein preliminary

assessment technical report issued in December 2006 used atmospheric leaching.

"While we expect this process change could result in an estimated 27%

reduction in the uranium plant operating costs, more importantly, it increases

the NPV of the project by 15% and reduces the uranium cash cost of production

for the Buffels project by an estimated 9%" said Mr. Miller. He added, "We are

encouraged by these results, but continue to evaluate the process plant

options. I am confident our project team will develop a flowsheet and

processing plan that delivers an optimum uranium recovery, capital and

operating cost estimate."

"The reduction in operating costs is attributable to the generation of

heat, acid and the oxidising environment in the pressure leach process,"

commented Jim Fisher, Chief Operating Officer. "This eliminates the need for

large quantities of sulphuric acid, coal and manganese, the major leach

reagents, resulting in a more environmentally friendly process."

The uranium recovery analysis, still at the preliminary assessment stage,

indicated that there was no significant change in capital required. However, a

detailed capital and operating cost estimate for the proposed process is

underway and First Uranium expects to complete a detailed feasibility level

study in April 2007.

All technical disclosure in this press release relating to the

Buffelsfontein tailings recovery project is extracted from a technical report

entitled "Technical Report - Preliminary Assessment of the Buffelsfontein

Project, Northwest Province, Republic of South Africa" (the "Technical

Report") originally submitted on November 8, 2006, revised on December 5, 2006

and further revised January 31, 2007 prepared in accordance with National

Instrument 43-101 ("NI 43-101") by R. Dennis Bergen, P.Eng and Wayne Valliant

P.Geo of Scott Wilson Roscoe Postle Associates Inc., each of whom is a

"qualified person" under NI 43-101 and is independent of First Uranium. The

disclosure contained in this press release has been reviewed and approved by

Mr. Bergen and Mr. Valliant.

The economic analysis contained in this press release is contained in the

Technical Report and is based, in part, on inferred resources, and is

preliminary in nature. Inferred resources are considered too geologically

speculative to have mining and economic considerations applied to them and to

be categorized as Mineral Reserves. There is no certainty that the reserves

development, production and economic forecasts on which the preliminary

assessment contained in the Technical Report is based, will be realized.

EZULWINI PROJECT

First Uranium has commenced underground development at its Ezulwini

project in South Africa as the company successfully initiated its first blast

a full two months ahead of schedule.

"This first blast marks the first steps toward the refurbishment,

stabilization and de-stressing of the shaft and surrounding pillar to prepare

Ezulwini for a twenty year mine life," said Miller.

Previously known as Randfontein Four shaft, the former gold and uranium

mine produced gold continuously until it was put on care and maintenance in

2001. It was also a significant uranium producer from 1982 to 1997, until

falling metal prices led to the mine being mothballed.

"While increased metal prices and changes in technology since the mine

was closed in 2001 now make the project viable, we could not have progressed

to this stage without the support of the South African Department of Minerals

and Energy (DME)," added Miller.

"As a result of the DME approving the new water barrier between Ezulwini

and the adjacent South Deep mine, it is now possible to mine the existing

water-barrier pillars that once controlled water inflow for the South Deep

mine. This new mine permit will allow us to destress and mine the previously

unmined shaft pillar.

"Mining both gold and uranium from the same ore body will allow us to

tailor production in order to maximize our revenues from Ezulwini depending on

market fundamentals and the outlook for uranium and gold prices."

The first gold from Ezulwini is expected to be produced by October 2007,

building up to 363,000 ounces per annum by 2010. Uranium production is

expected to begin in June 2008.

This press release contains and refers to forward-looking information

based on current expectations. All statements other than statements of

historical fact included in this release including, without limitation,

statements regarding potential production rates and operating costs,

processing and development plans, estimated net present values and future

plans and objectives of First Uranium are forward-looking statements (or

forward-looking information) that involve various risks and uncertainties.

There can be no assurance that such statements will prove to be accurate, such

statements are subject to significant risks and uncertainties, and actual

results and future events could differ materially from those anticipated in

such statements. Important factors could cause actual results to differ

materially from First Uranium's expectations. Such factors include, among

others, the actual results of the planned feasibility study on the

Buffelsfontein project, the actual results of additional exploration and

development activities at First Uranium's projects, the timing and amount of

estimated future production, costs of production, capital expenditures, costs

and timing of the development of First Uranium's projects, availability of

capital required to place First Uranium's projects into production,

conclusions of economic evaluations, changes in project parameters as plans

continue to be refined, future prices of commodities, failure of plant,

equipment or processes to operate as anticipated, accidents, labour disputes,

delays in obtaining governmental approvals, permits or financing or in the

completion of development or construction activities, currency fluctuations,

as well as those factors discussed under "Risk Factors" in First Uranium's

final prospectus dated December 12, 2006 as filed with securities regulatory

authorities in Canada. Although First Uranium has attempted to identify

important factors that could cause actual results to differ materially, there

may be other factors that cause results not to be as anticipated, estimated or

intended.

These forward-looking statements are made as of the date hereof and there

can be no assurance that such forward-looking statements will prove to be

accurate as actual results and future events could differ materially from

those anticipated in such statements. Accordingly, readers should not place

undue reliance on forward-looking statements. First Uranium does not undertake

to update any forward-looking statements that are included herein, except in

accordance with applicable securities laws.

First Uranium Corporation (FIU:TSX) is focused on the development of

South African uranium and gold mines with the goal of becoming a significant

producer through the re-opening and development of the Ezulwini underground

mine and the construction of the Buffelsfontein tailings recovery facility.

First Uranium also plans to grow production by pursuing acquisition and joint

venture opportunities.

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

0

Toronto-listed First Uranium Corporation on Friday announced that it had mobilised its project teams and was making ?good progress on several fronts? with underground development at its Ezulwini project, west of Johannesburg, and the evaluation and selection of the optimal process flowsheet for the recovery of uranium at its Buffelsfontein project.

?The net result of these developments is very positive for First Uranium. We now expect, subject to the completion of a feasibility study, that, at Buffelsfontein, we should be able reduce costs and, with activity already underway at Ezulwini, we have gained even more confidence in our production plan and budget," said CEO Gordon Miller.

As the initial stage towards a feasibility study, First Uranium had completed an evaluation to determine an optimised uranium recovery process for its Buffelsfontein project uranium plant.

The initial results of this study suggested the most viable flowsheet would involve pressure leaching.

?While we expect that this process change could result in an estimated 27% reduction in the uranium plant operating costs, more importantly, it increases the net present value of the project by 15% and reduced the uranium cash cost of production for the Buffels project by an estimated 9%,? said Miller. ?We are encouraged by these results, but continue to evaluate the process plant options. I am confident that our project team will develop a flowsheet and processing plan that delivers an optimum uranium recovery, capital and operating cost estimate.?

?The reduction in operating costs is attributable to the generation of heat, acid and the oxidising environment in the pressure leach process,? commented COO Jim Fisher.

Meanwhile, First Uranium had begun underground development at its Ezulwini project as the company successfully initiated its first blast two months ahead of schedule.

?This first blast marks the first steps toward the refurbishment, stabilization and de-stressing of the shaft and surrounding pillar to prepare Ezulwini for a twenty year mine life,? said Miller.

Previously known as Randfontein Four shaft, the former gold and uranium mine produced gold continuously until it was put on care and maintenance in 2001. It was also a significant uranium producer from 1982 to 1997, until falling metal prices led to the mine being mothballed.

?While increased metal prices and changes in technology since the mine was closed in 2001 now make the project viable, we could not have progressed to this stage without the support of the South African Department of Minerals and Energy (DME),? added Miller.

?As a result of the DME approving the new water barrier between Ezulwini and the adjacent South Deep mine, it is now possible to mine the existing water-barrier pillars that once controlled water inflow for the South Deep mine. This new mine permit will allow us to destress and mine the previously unmined shaft pillar,? he said.

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

0

sehr Euch dazu auch die Seite auf der homeopage, Förderkosten,e tc an

viel glück

News Today

Gold junior set on uranium diversification strategy

South African junior miner Simmer & Jack (Simmers) has historically been associated with gold-mining, but owing to the currently firm market fundamentals within the uranium sector and increasing prices on a sustained basis, the company has elected to diversify its traditional focus to pursue a separate uranium strategy. Owing to the fact that the fundamentals between the two commodities are so different, this uranium strategy is being undertaken by the company?s subsidiary, First Uranium, of which Simmers has a 70% shareholding and the remaining 30% is owned by Canadian private entity First Uranium.

In an interview with Mining Weekly, Simmers CEO Gordon Miller explains that the company took the decision to diversify its commodity focus based on positive analytical information from offshore advisers.

?Our advice, which has been based on information provided by the large Canadian and European investment banks, is that as the supply of uranium becomes more constrained, the price will rise and could be sustained at an average of $45/lb in the medium term,? explains Miller. ?In addition, we have been advised that we are working within a seven-year cycle because the timing to get new projects online worldwide is immensely difficult owing to strict permitting and regulations.? However, in this regard, Miller argues that South Africa has a com- petitive advantage over other uranium-rich countries in that most of the mines with uranium-bearing deposits have permits in place already because of the country?s historical mining activities. ?Because global production of new uranium is not going to come online for the next few years, the market is going to be driven by supply-and-demand fundamentals, which could cause the uranium price to be sustained for a number of years,? elabo-rates Miller. ?Consequently, the market outlook for uranium is very positive at this point and has inevitably encouraged our diversification strategy.? Miller further elaborates that the company?s operating strategy for the medium-term has been based on the uranium price remaining at $45/lb for the next seven years and, subsequently, stabilising at a long-term price of $25/lb.

However, not only are the market fundamentals presenting an encouraging situation for the company, but Miller explains that the management team within First Uranium, including the company?s CEO, Jim Fisher, Graham Wanblad, the technical di- rector and Roland Freeman, the chief mechanical and electrical engineer, all have previous experience in uranium-mining, particularly with regard to the old Western Areas mine. First Uranium is, thus, in a strong position to take advantage of the current upcycle in the uranium market, which will primarily be achieved through its Buffelsfontein operation in the Free State and, subject to the granting of the new-order mining right, the Ezulwini operation.

Buffelsfontein

The Buffelsfontein operation was acquired from DRDGold in July last year after the mine was placed under provincial liquidation in March owing to the earthquake that caused extensive damage to its No 5 shaft. Although this operation is primarily a gold-mine, uranium has always been a significant by-product of this mine. Consequently, with the upturn in the uranium market, Simmers embarked on a feasibility study in Nov- ember to assess the viability of surface mining for uranium in the tailings dams surrounding the current operational mine. The first phase of the feasibility study, which involved extensive drilling and sampling of the tailings dam, was completed in January this year and, according to Miller, all indications suggest that this project is highly workable. According to the resource statement, which was released during the first quarter, the tailings dams, using a zero grade cut-off, are estimated to contain measured and indi-cated uranium mineral resources of 43,6-million pounds of U308 grading at 0,15 lb/t.

The resources are contained in 283-million tons of relatively homo- genous tailings dams and metallurgical testwork is currently under way to determine the most cost-effective extraction methods.

Based purely on the surface re-treatment opportunity, the initial results indicate a 15-year project life, with the potential to extract 12-million pounds of uranium at a throughput rate of one-million tons of surface material a month.

The underground mine will also be sending uranium to the mill and the potential to recover this by-product metal will be assessed when the underground mine completes its mineral-reserves statements.

The next important step for the feasibility study is to complete the metallurgical testwork that will be conducted over the next few months in order to arrive at a definitive process design for coextraction of gold and uranium. ?Although mining uranium requires a very simple mining method, it is very difficult to get uranium out of tailings, so we have assumed pretty low recoveries in our current forecast model,? explains Miller. ?We are assuming that we are going to get about 28% of the uranium that is contained in the tailings, which is what the initial metallurgical results show.? Miller elaborates that this is because the uranium sits in the fine fraction of the tailings dam, 56% of which is actually in the ultra fine component of the tailings. There are obviously technologies that can be used to improve our recovery ratio, but Miller explains that it is always going to be a balance between cost versus recovery, although the company will go through optimisation strategies as part of this feasibility study.

?The project is fully funded by First Uranium Corporation, which has raised $3-million in private equity to fund the bankable feasibility study,? Miller tells Mining Weekly.

?Should the feasibility study prove to be viable, the Canadian company is obliged to inject a further $25-million in equity to fund the construction of the extraction plants.

?The provision of this funding will result in their ownership increasing to 49% of this project.?

Ezulwini

The other uranium project that Simmers is focussing on is the ex-Western Areas and Harmony property (Randfontein 4 Shaft) that has been renamed Ezulwini.

However, this controversial pro-ject has been receiving a lot of attention during the last few months, especially with regard to the company?s black economic-empowerment status.

To this extent, Miller explains that this project is largely misunder- stood in that Ezulwini is a new-order mining-right application and, con-sequently, Simmers is of the view that it will be in full compliance with all the legal requirements of the current legislation. When the mining-right application for Simmers? 90%-owned Ezulwini company is approved, its gold and uranium assets will be held by Simmers and not First Uranium, but First Uranium is currently considering options for it to acquire Ezulwini?s uranium resources should the mining right be granted to Simmers.

Historic data on this shaft indicates that it has some 1,7-million tons of proved gold at 8,7 g/t. Total measured and indicated reserves come to 19,1-million tons at 6,5 g/t - figures that do not take into account the main shaft pillars, which could add a further 1,5-million tons at 6,04 g/t.

Miller adds that there are also uranium underground resources, which the firm might access at a later stage. Currently, the firm is busy with a feasibility study that is examining the possibility of mining the pillar shafts and this should be completed in the first quarter. Once this has been completed this quarter, and once the Depart-ment of Minerals and Energy awards the licence, mining can start.

However, the firm would require around $50-million in capital to acquire equipment, refurbish the shaft, fix haulages, and supply power. But this expense would also enable Ezulwini to gain access to some 35-million pounds of inferred high-grade uranium resources contained in the abandoned uranium-mine.

According to Miller, if the application for Ezulwini is approved, there are a number of ways that Simmers will raise the capital for this project. ?We will raise capital through a placement of shares, although we prefer to do as little of this as possible and see if we can actually raise offshore capital out of Toronto using First Uranium?s equity rather than Simmers? equity,? concludes Miller.

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

0

It could also lower production costs by as much as 9%.

Author: Stewart Bailey, Bloomberg

04 February 2007

First Uranium, a Toronto-based developer of uranium deposits in South Africa, said a change to the way it will process uranium-from-waste at its Buffelsfontein project could cut plant investment costs by 27%.

The change to "atmospheric pressure leaching" to extract uranium from mine waste could also lower production costs by as much as 9% and boost the value of the project by 15%, First Uranium said on Friday in an e-mailed statement.

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

0

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

0

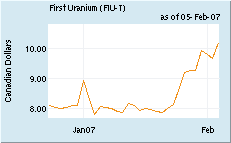

Symbol Last Trade $ Change % Change Volume

FIU 10.230 +0.030 +0.29 719,019 T

Quoted Market Value 1,241,197,679

First Uranium Corporation (First Uranium) is a resources company focused on the development of uranium and gold projects in South Africa. The Company focuses on producing uranium and gold through the reopening and development of the Ezulwini underground mine and the construction of the Buffelsfontein tailings recovery facility. The Ezulwini Project will involve the recommissioning of underground uranium and gold mining operation located approximately 40 kilometers from Johannesburg on the outskirts of the town of Westonaria in Gauteng Province, South Africa. The mine is operating on a care-and-maintenance basis. The Buffelsfontein Project is a uranium and gold tailings recovery operation located in the Western portion of the Witwatersrand Basin, approximately 160 kilometers from Johannesburg.

5 Press Avenue, Selby

Johannesburg,

ZAF

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

Angehängte Grafik:

fiu.png

fiu.png

1

Optionen

| Antwort einfügen |

| Boardmail an "gurti" |

|

Wertpapier:

First Uranium

|

0

US

FIU 11.11 steigend Vol = 358,631.00

11:25 11.110 400 +0.260 RBC ITG

11:24 11.110 500 +0.260 TD Securities ITG

11:24 11.100 600 +0.250 Canaccord ITG

11:24 11.100 400 +0.250 RBC ITG

11:24 11.100 300 +0.250 Canaccord ITG

11:24 11.100 200 +0.250 RBC ITG

11:24 11.100 9,000 +0.250 Canaccord UBS Securities

11:24 11.100 500 +0.250 Canaccord ITG

11:24 11.090 400 +0.240 Canaccord ITG

11:19 11.060 300 +0.210 RBC ITG

viel Glück

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

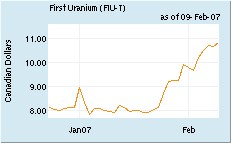

Angehängte Grafik:

fiu.png

fiu.png

0

Last CAN

FIU 11.160 +0.310 +2.86 557,964 T

Rolling 52 Week High 11.590

Rolling 52 Week Low 7.750

Quoted Market Value 1,358,016,285

# of Shares Outstanding 121,686,047

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

0

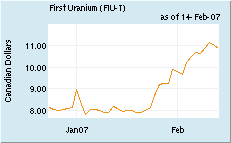

First Uranium steigt, Uran steigt und....

FIU 11.340 +0.180 +1.61 111,740 T

§

Last Trade: 13 Feb 2007 11:44 ET

Price 11.340 Net

Change +0.180

Last§

Bid Size 25 Volume 111,740

Last

Bid Price 11.300 Open 11.550

Last

Ask Price 11.340 High 11.690

Last

Ask Size 5 Low 11.160

viel Glück

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

0

Greetings

Umsätze steigen..

mehr (wenn auch spärlich) Infos:

http://fr.advfn.com/...company_data&symbol=TSE%3AFIU&annual_reports=3

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

Angehängte Grafik:

p.gif

p.gif

0

1 US$ = 0.77174 ?

U3O8 Price (lb) $75.00 [+3.00] ?57.88 [+2.32]

NA Conv. (kgU) $11.50 [-0.25] ?8.87 [-0.19]

EU Conv. (kgU) $11.15 [-1.35] ?8.60 [-1.04]

NA UF6 Price (kgU) $208.00 [+9.00] ?160.52 [+6.95]

NA UF6 Value* (kgU) $207.46 [+7.58] ?160.10 [+5.85]

EU UF6 Value* (kgU) $207.11 [+6.48] ?159.83 [+5.00]

SWU Price (SWU) $135.00 [Unch.] ?104.18 [Unch.

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

Angehängte Grafik:

uxc_g_u3o8-sm.gif

uxc_g_u3o8-sm.gif

0

Optionen

| Antwort einfügen |

| Boardmail an "Ohio" |

|

Wertpapier:

First Uranium

|

0

entweder in Toronto (FIU) oder bei Deinem D broker in Frankfurt o Berlin (ich habe sie in TOR und FRA gekauft)bzw OTC (FURAF) in den USA (mit Vorsicht zu geniessen...musst Du Deinen broker in den US gut kenne, OTC Handel halt).

Der Handel hier in D lässt nur noch sehr zu wünschen übrig. denke aber das wird noch kommen, wenn die "grossen" Schnüffler wieder aufwachen und von Urasia wegschauen (auch so'n netter Wert..genauso wie jetzt SRX, wenn er sich beruhigt hat..)

Allerdings (musst Du bei Deinem broker/Händler rückfragen) ich kann meine Aktien kostenfrei in die USA (OTC) bzw nach CAN (TSX)transferieren lassen (!!dauert allerdings 1-2 (!!) Wochen bis sie dann dort handelbar sind).

ABER: who cares ;-)

Ich bin davon überzeugt, dass die Uranstory noch ein paar Jahre läuft UND das die Übernahmen, Zusammenschliessungen weitergehen (Ressourcen, Monopol nachfrage).

Positiv ist hier in dem Fall, dass die Uranproduktion erstens sehr hochwertiges Uran produziert, das die Mine schon existiert, allerdings nach dem ersten Uran hype in den 60/70 stillgelegt wurde ABER hohe nachgewiesen Vorkommen da sind,

UND "der Bringer":

es ein Abfallprodukt neben der laufenden und geplanten Goldproduktion ist !!!! (Du kannst die 7xxt x Goldpreisx Spekulations rechnungen (Milchmädchen..) in Ihrem Vortrag nachlesen, selbst wenn "nur"das stimmt, stehen sie sehr gut da.

Mit den geplanten Produktionskosten liegen sie SEHR weit unten an der Kostenskala, mit ein bisschen Glück sind die Vorkommen noch grösser als geplant, da das Gebiet nur teilweise durchforscht ist.

OTC

FURAF / USD 10,01

0 +0,461

+4,82 23:20:45

13.02.2007 -

- 9,55

6,69 10,01

9,75 500

0

So mit ein bisschen Glück sind mehr als 100% drin, 'mal schauen...;-), wieder spannend. Steigt täglich ein bisschen, das Volumen in TOR nimt zu....mmh.

viel Glück

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

0

10:04 10.630 2,000 -0.250 Anonymous

10:04 10.650 1,000 -0.230 CIBC Anonymous

10:04 10.650 200 -0.230 RBC Anonymous

09:58 10.650 600 -0.230 RBC TD Securities

09:58 10.650 400 -0.230 RBC TD Securities

09:57 10.650 600 -0.230 RBC Dundee

09:57 10.650 400 -0.230 RBC Dundee

09:57 10.650 20 OLT RBC RBC

09:57 10.650 100 -0.230 RBC RBC

09:57 10.650 100 -0.230 RBC RBC

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

Angehängte Grafik:

fiu.png

fiu.png

0

First Uranium seeks JSE secondary listing

TSX-listed First Uranium Corporation said on Wednesday that it was in the process of applying for a secondary listing on the JSE.

In a note to the TSX announcing its results for the third quarter ended December 31, the firm said that it had recorded a R265,6-million loss for the period, or a R4,95 loss for each share.

As First Uranium, in which South African gold-miner Simmer and Jack holds a majority share, was not yet in production, no revenue was recorded in the quarter.

The net loss reflected foreign exchange losses of $2,7-million, incurred on related-party transactions and an operating loss of $1,6-million.

These costs were partially offset by interest income earned on the proceeds of the initial public offering of common shares on the TSX, which was completed on December 20.

?Our belief in the potential for First Uranium was solidly endorsed by investors in North America and Europe, as proven by the success of our initial offering and the subsequent sale of the over-allotment," said First Uranium president and CEO Gordon Miller. ?The cash proceeds of this transaction have allowed the company to accelerate the development of its two South African operations, the Buffelsfontein tailings re-treatment project and the Ezulwini underground mine, to produce uranium and gold.?

The company's Buffelsfontein tailings recovery project was targeted to begin in 2008 and achieve an average yearly production, from 2010 to 2021, of 145 500 oz of gold and 998 800 lb of uranium.

Gold production at the Ezulwini mine was planned to begin in October 2007, and uranium production was expected to begin in June 2008, and achieve an average yearly production, from 2009 to 2024, of 320 000 oz of gold and 989 000 lb of uranium.

Anm.: Johannesburg Securities Exchange (JSE)

Gold-0,38%

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

0

Simmer & Jack ist schon gelistet

Neuer Report zu exakten daten der Projekte Buff, etc im April

Produktion bei der Ezulwini mine( 6,8-million pfund at a grading of 1,77 lb/t ab Juni 08).(Das gleiche Projekt hat Goldreserven von 3,1-million Unzen bei 4 g/t.)"

Listing is one of five priorities for First Uranium this year

Uranium development company First Uranium has announced that it has established a number of key objectives for 2007 that will potentially enhance the status of the company in the short term and facilitate progress towards the development of the company?s first uranium mine by the first quarter of next year. First Uranium CEO Gordon Miller explains that five fundamental objectives have been prioritised for this year.

Chief among these, states Miller, is the company?s intention to list on the JSE by the end of March.

Miller explains that the company will be listing on the local bourse in order to comply with the South African Reserve Bank?s foreign exchange regulations, although it should be noted that the com- pany?s major shareholder, Simmer & Jack, is presently listed on the JSE.

First Uranium has already taken the opportunity of marketing itself by association with the local bourse at this year?s first JSE Mining Showcase, held in Cape Town, last week.

Secondly, the company intends to complete recruitment of historically disadvantaged South African executive and management individuals.

Miller states that First Uranium also intends to release a new technical report for each of the com- pany?s projects, including Buffels-fontein and Ezulwini, by April this year. Similarly, the company intends to lay the groundwork to achieve the conversion of all inferred resource estimates to a measured and indicated category, thereby allowing First Uranium to up- date reserve figures for each pro-ject. In addition, the company intends to raise the status of the study at the Buffelsfontiein operation to a full feasibility through detailed budget estimates. To date, First Uranium has completed an evaluation to deter-mine an optimised uranium recovery process for this opera-tion. The initial results of this study suggest that the most viable flow sheet would involve pressure leaching.

A detailed capital and opera- ting cost estimate for the pro- posed process is under way and First Uranium expects to complete a detailed feasibility study by April.

Looking beyond 2007, Miller anticipates that the company will begin uranium production at the Ezulwini mine, which has a resource of 6,8-million pounds at a grading of 1,77 lb/t, by June next year.

Miller adds that this project also has a gold resource of 3,1-million ounces at 4 g/t.

First Uranium commenced underground development at this project earlier this year, two months ahead of schedule. Miller concludes that, with the successful completion of these objectives, First Uranium will be well positioned to take advantage of the strong fundamentals in the uranium market while it is still in an upcycle.

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

0

kursverdopplung moeglich.Wandler

Optionen

| Antwort einfügen |

| Boardmail an "wandler" |

|

Wertpapier:

First Uranium

|

0

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

0

13:36 10.650 900 +0.270 Penson RBC

13:35 10.700 100 +0.320 E*TRADE Sec. Ntl. Bank Fin.

13:33 10.700 300 +0.320 Anonymous Ntl. Bank Fin.

13:27 10.700 2,000 +0.320 Ntl. Bank Fin. Ntl. Bank Fin.

13:25 10.700 1,000 +0.320 TD Securities Ntl. Bank Fin.

13:22 10.650 100 +0.270 Penson GMP Securities

13:22 10.650 400 +0.270 TD Securities GMP Securities

13:22 10.670 300 +0.290 Anonymous GMP Securities

13:22 10.680 800 +0.300 Ntl. Bank Fin. GMP Securities

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

0

12:41 10.900 200 +0.220 Anonymous RBC

12:39 10.880 1,000 +0.200 CIBC Canaccord

11:58 10.870 500 +0.190 Anonymous TD Securities

11:58 10.870 500 +0.190 RBC TD Securities

11:56 10.900 40 OLT Interactive RBC

11:35 10.900 60 OLT CIBC RBC

11:35 10.900 300 +0.220 CIBC RBC

11:33 10.900 1,000 +0.220 Pictet RBC

11:28 10.890 400 +0.210 Anonymous Questrade

11:28 10.890 600 +0.210

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

0

FIU 10.850 +0.170 +1.59 96,120

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

0

Optionen

| Antwort einfügen |

| Boardmail an "skunk.works" |

|

Wertpapier:

First Uranium

|

Thread abonnieren

Thread abonnieren