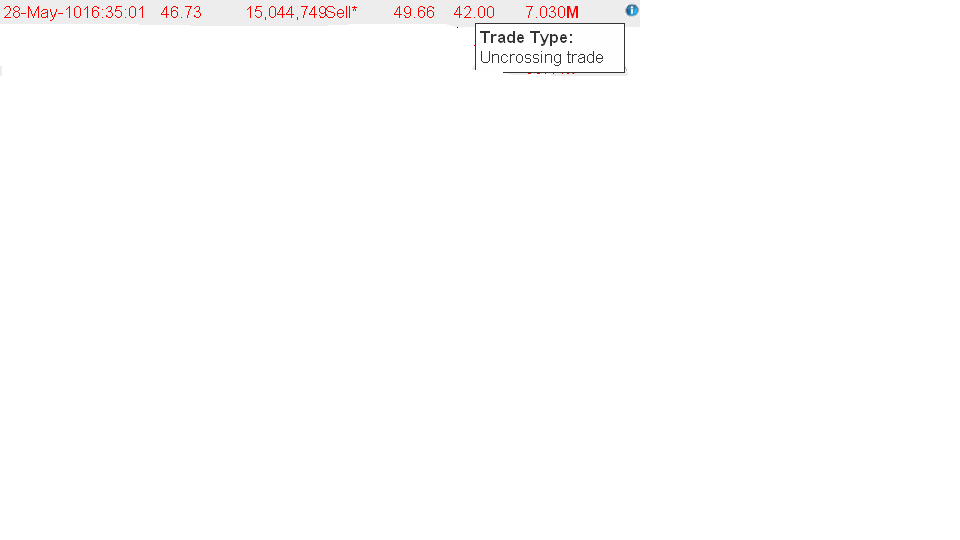

Uncrossing Trade

This is used for the single uncrossing trade, detailing the total executed volume and uncrossing price as a result of a SETS auction

SETS

Stock Exchange Electronic Trading Service (SETS), an order-driven trading service.

SETS auctions

At the beginning and end of the day there are SETS auctions.

This is a process to open and close the market, and gives

participants an opportunity to enter into a five minute bidding

process. This bidding can extend if the results are too extreme.

The idea of the auction is to provide an event to mark the

opening and closing and enable parties to square their positions.

This auction process can also start at anytime during the day if

an order that is about to be executed would move a share price

by 5%. The end of day auction is a particularly exciting trading

moment as it represents a time when prices can move suddenly.

The basic auction has a five minute duration, in which parties

can enter bid and offers as usual in the book, and special orders

called Market Orders can also be placed. A market order is an

order that will be filled at the end of the auction at the ?uncrossing

price? ? the price set by the matching of all bid and offers and

market orders that match. This uncrossing price moves as orders

are entered and deleted, and after a random period of up to 30

seconds after the ?five minute? auction, the uncrossing price is

fixed and the auction settled.

The auction opportunity

The end of day auction kicks off at 4.30pm (GMT) and

uncrossing prices can fluctuate wildly as many parties watch

the uncrossing price, and attempt to obtain an advantageous price

|

Angehängte Grafik:

rbs_traders2.png (verkleinert auf 53%)