P&F Chart Patterns

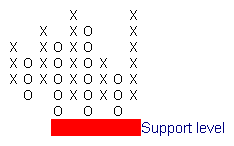

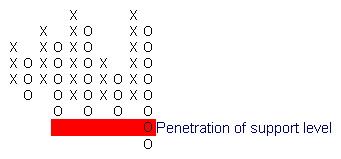

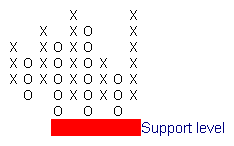

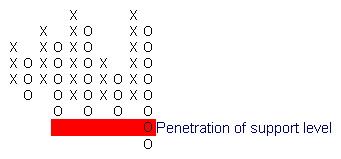

Support levels are price levels at which large numbers of buyers are expected to enter the market. They are easily identified on Point and Figure charts by 2 or more columns of O's bottoming out at the same level.

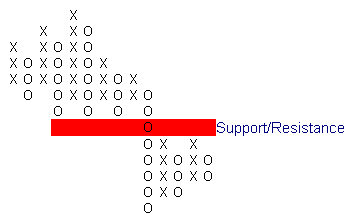

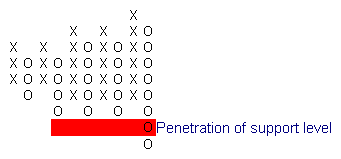

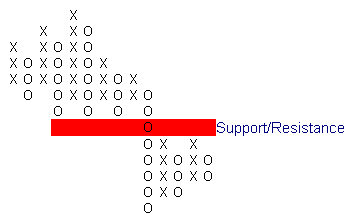

When penetrated, support levels often become resistance levels.

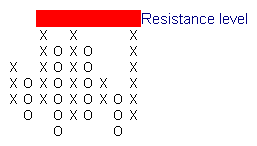

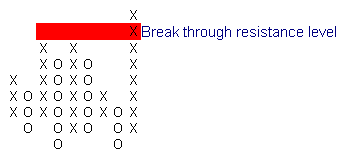

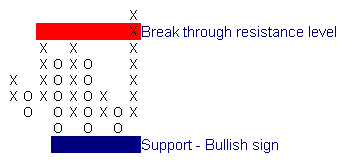

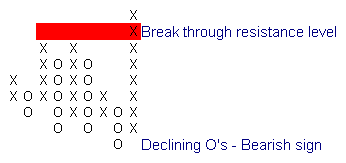

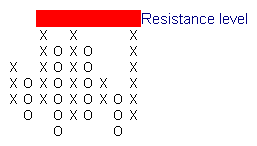

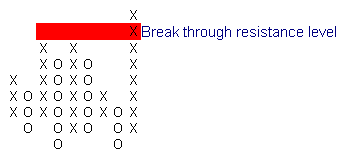

Resistance levels are prices at which large numbers of sellers are expected to enter the market. You can identify them by 2 or more columns of X's ending with equal tops.

When penetrated, resistance levels often become future support levels.

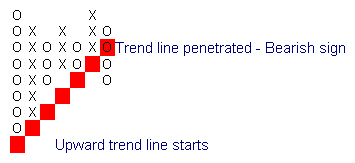

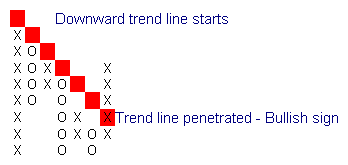

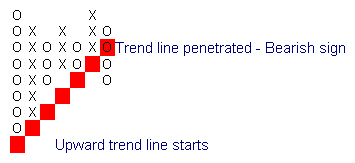

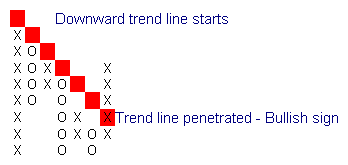

Trend lines on point and figure charts are plotted at an angle of 45 degrees (one square across and one up/down).

An up-trend will always be first penetrated by a column of O's and a down-trend by a column of X's.

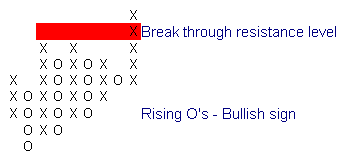

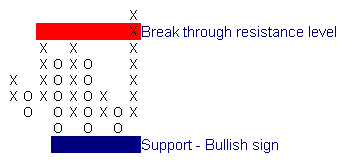

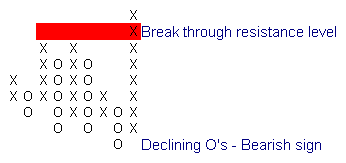

A breakout above a resistance level is a bullish signal.

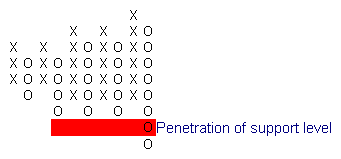

Penetration of a support level is generally bearish.

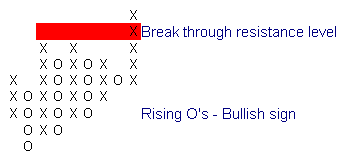

When you encounter penetration of a support or resistance level, examine the chart carefully for supporting evidence. The following pattern of rising columns of O's gives further confirmation of the breakout.

The next pattern shows a strong support base for the breakout - still a bullish signal.

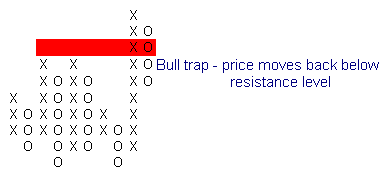

But the next pattern hints of a weak breakout that may result in a bull trap.

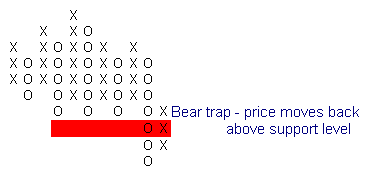

The same patterns can be identified with support level penetrations. Is the following penetration of the support level likely to hold?

Rising columns of X's signal weakness - be on the alert for a bear trap.

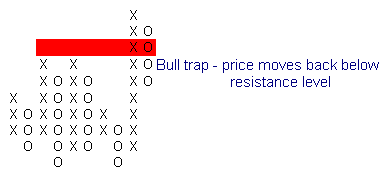

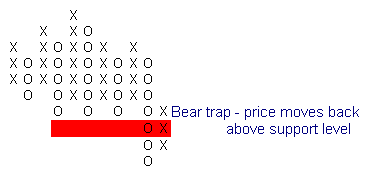

One of the most reliable patterns is where a breakout moves back below a resistance level (or back above a support level).

Go short with a bull trap. Go long when a bear trap occurs.

- Bear traps are more reliable in an up-trend.

They may also signal a reversal after an extended down-trend. - Bull traps are more reliable in a down-trend.

They may also signal a reversal after an extended up-trend.

Thread abonnieren

Thread abonnieren