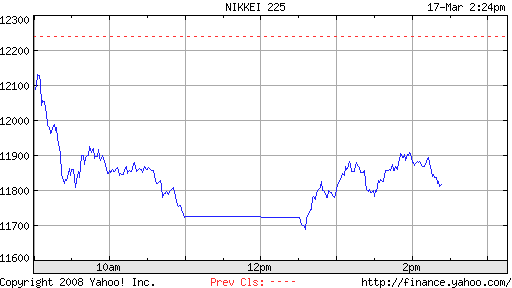

NIK 11,819.28 Down 422.32 (-3.45%)

Japanese stocks fell over 3 percent to about a two-and-a-half year low on Monday, dragged down by exporters such as Toyota Motor Corp (7203.T: Quote, Profile, Research) as the dollar hit a 13-year low against the yen, casting a cloud over their earnings outlooks.

Financial shares took a beating as the acquisition of Bear Stearns (BSC.N: Quote, Profile, Research) by JPMorgan Chase (JPM.N: Quote, Profile, Research) exacerbated fears that more financial institutions could become casualties in the widening U.S. financial crisis. [ID:nN16640873]

Investors largely shrugged off the announcement of a Federal Reserve discount rate cut, which market players said was unlikely to be more than a stop-gap move. [ID:nN16507166]

Masaru Hamasaki, a senior strategist at Toyota Asset Management, said the yen had advanced so much in such a short time that companies would find it hard to cope.

"If the yen stays around this level, exporters' earnings will be negatively impacted, not only this year but next year," he said.

"After the de facto bankruptcy of Bear Stearns, investors will likely keep a lookout for similar problems at other banks, though I think we have already seen the extreme situation."

|

Angehängte Grafik:

b.png (verkleinert auf 99%)

|

2 |

3 |

4

|

2 |

3 |

4

Thread abonnieren

Thread abonnieren

115.30 (2.18%)

115.30 (2.18%)